M&A in Wine Country

Finance Simulation

Simulation Overview

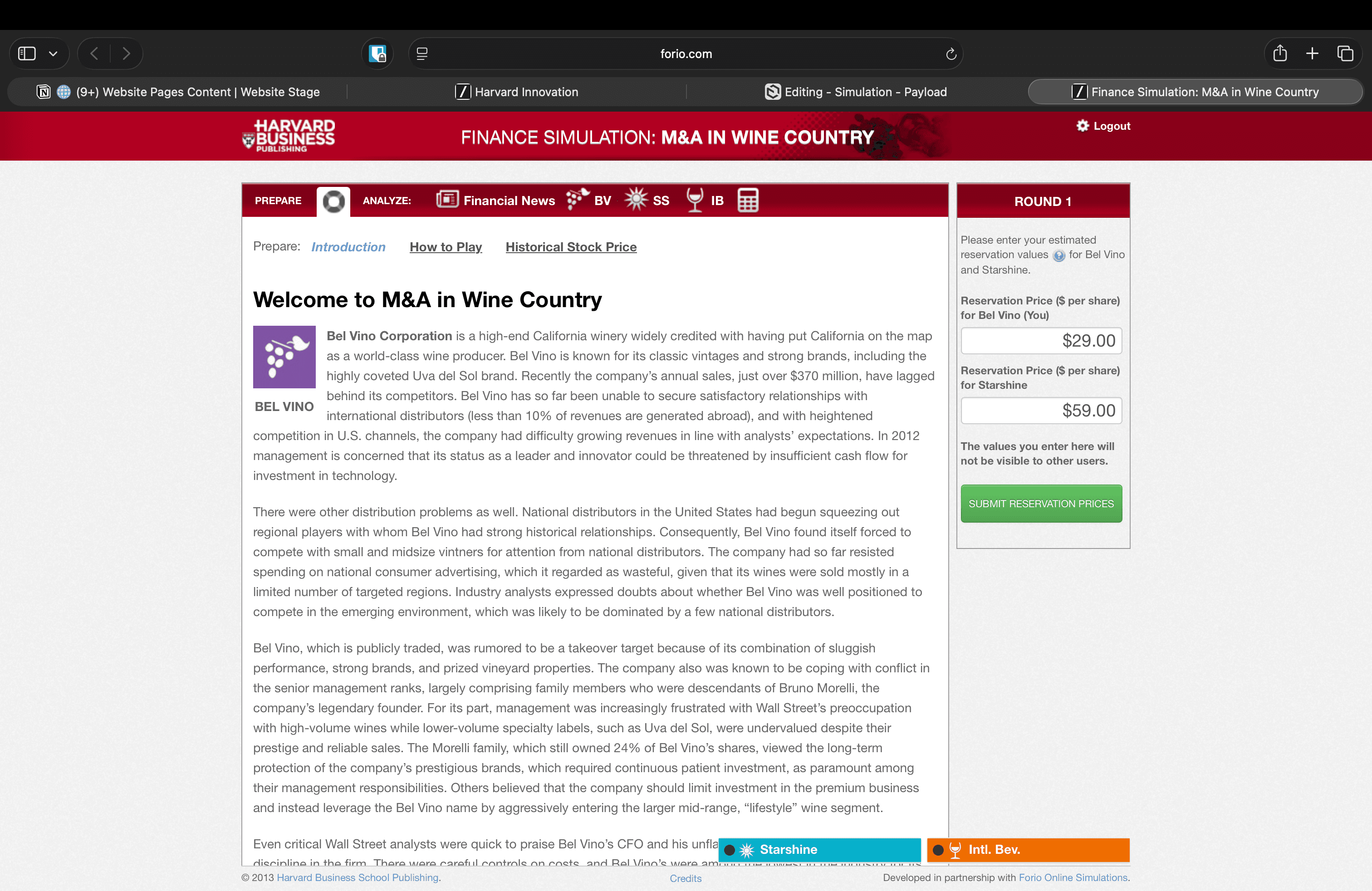

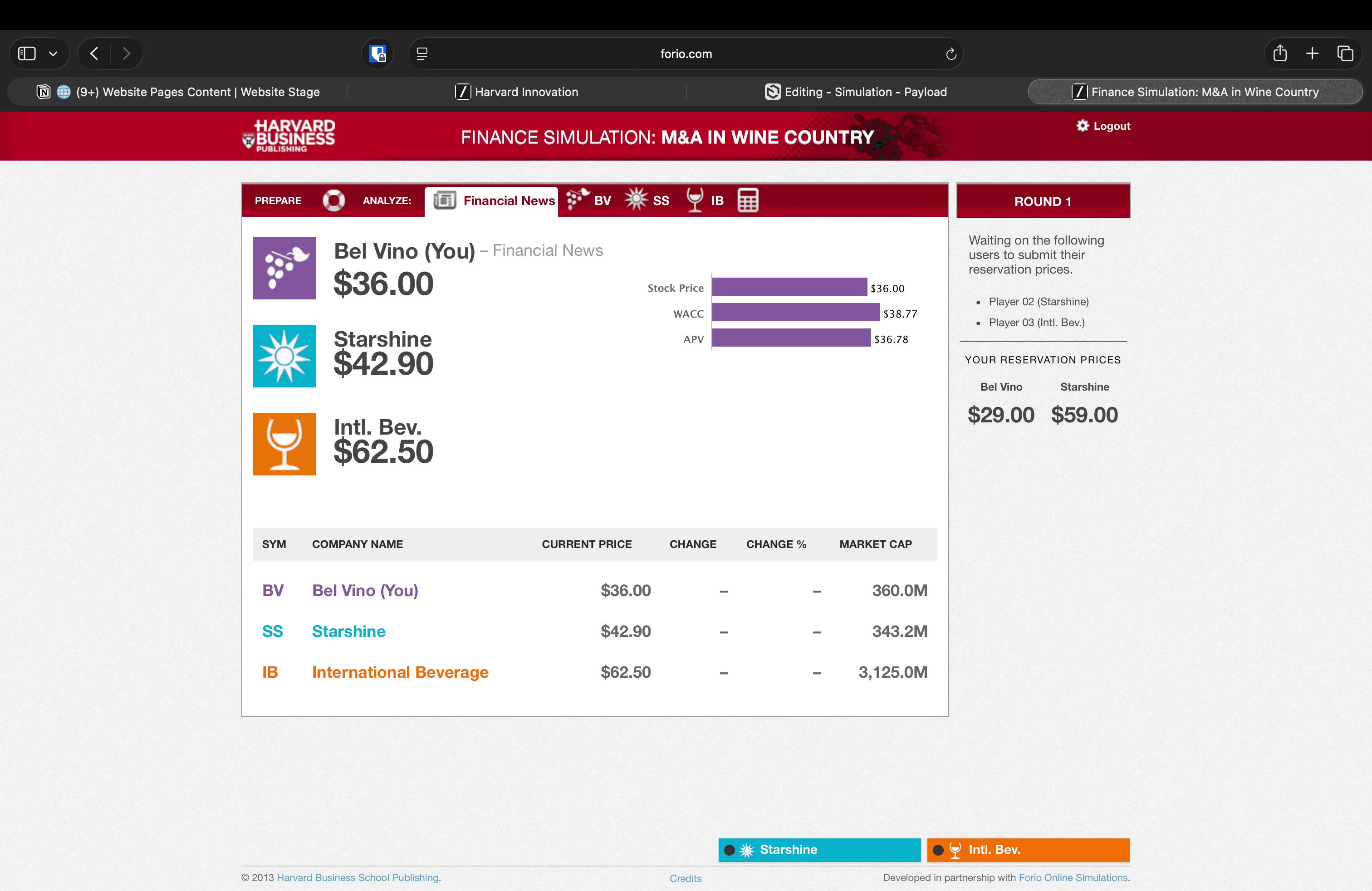

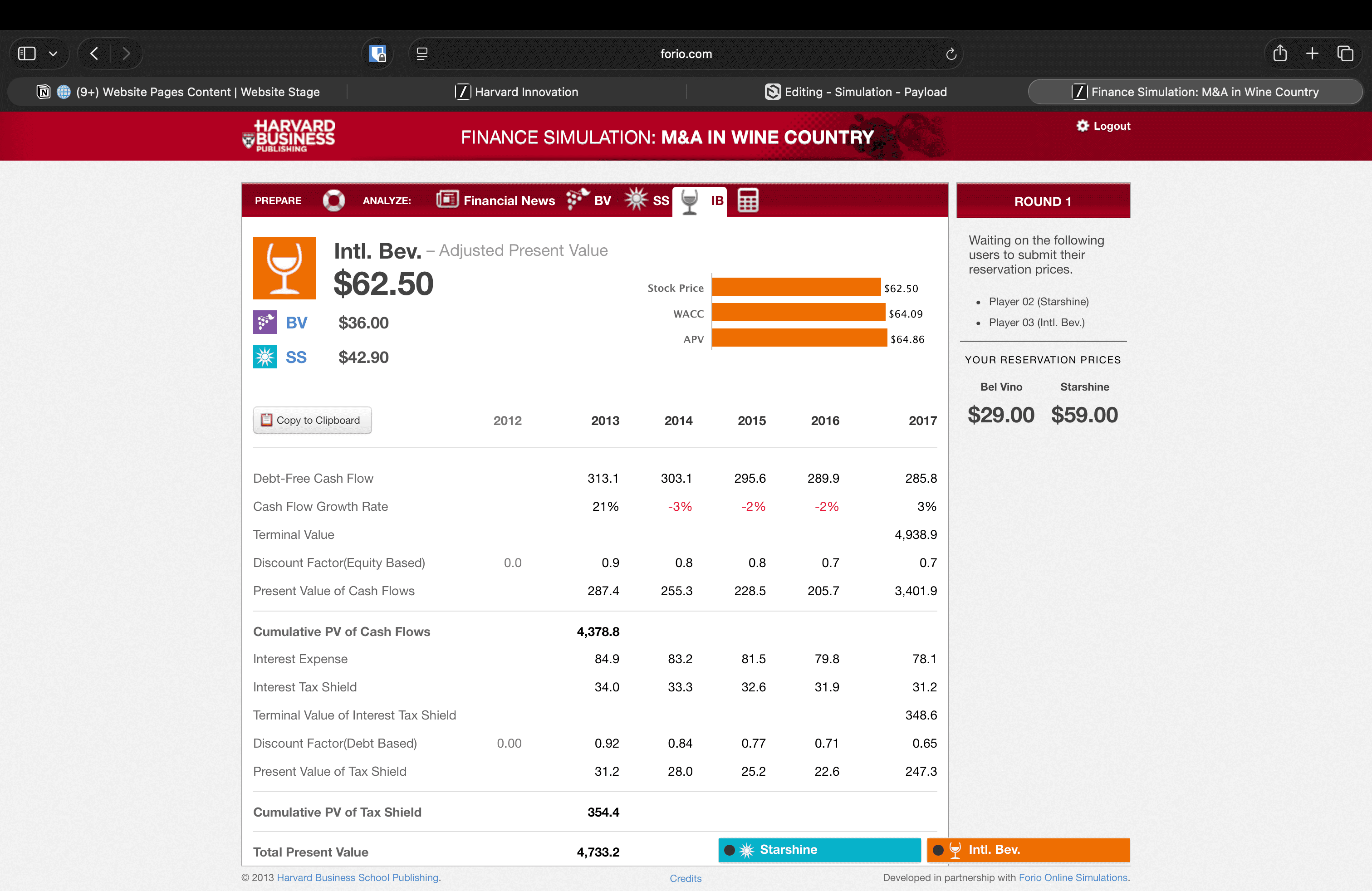

The M&A in Wine Country simulation places each student in the role of CEO of Bel Vino, Starshine, or International Beverage, where they evaluate merger opportunities, determine reservation prices, and engage in dynamic, competitive negotiations. Using analyst projections, historical stock data, and rigorous valuation methods, students submit bids and counteroffers, negotiate in real time, and observe the resulting changes in stock price. The simulation emphasizes M&A strategy, valuation, synergy forecasting, and negotiation skills, providing a capstone experience that integrates corporate finance and strategic decision-making.

Players

Multiplayer

Languages

English

Simulation Time

Total Time: 1.25-2 hours

Intro 15 minutes, Gameplay 30-45 minutes, Debrief 30-60 minutes

Accessibility

No Accessibility Compliance

Price

$165 per person

Simulation Categories

The Story

Three publicly traded wine producers—Bel Vino, Starshine, and International Beverage—are locked in a high-stakes struggle to shape the future of their industry. As CEO of one of these firms, you face a volatile market where shifting analyst projections, fluctuating stock prices, and whispers of synergies put every company in play. Armed with confidential financial data, discounted cash-flow valuations, and real-time market feedback, you must decide not only what your company is worth—but what an acquisition target might be worth to you.

The simulation unfolds in two tense rounds. First, you determine reservation prices for both Bel Vino and Starshine, relying on valuation methods like WACC-based DCF, APV, and market multiples to interpret the financials and forecast potential synergies. Then, as bids go public, rivals respond with counteroffers, stock prices move in real time, and a built-in chat allows you to negotiate live—all while pursuing the goal of maximizing your own shareholders’ value. Competitive pressures escalate as new offers appear on the screen, and players must decide whether to walk away, sweeten the deal, or strike quickly before another bidder steps in.

Ultimately, the simulation mirrors the exhilarating and unforgiving landscape of real-world M&A: imperfect information, hard valuation choices, strategic negotiations, and the ever-present tension between value creation and value transfer. The outcome depends not just on the numbers—but on how effectively you negotiate under pressure.

Core Competencies

Negotiation and Tradeoffs

Financial Decision Making

Accounting and Budgeting

Learning Objectives

Resources to Power Your Simulation

This simulation comes with a Facilitation Guide along with 1:1 facilitator training and free trial accounts.

Available with this simulation

Facilitation Guide

Debrief Slides

Facilitator Video

Student Video

Free Trial & Demo

Check Out Similar Forio Sims

Entrepreneurship

The Balanced Scorecard

In this multi-player asynchronous simulation from Harvard, learners can experience the pros and cons of using a balanced scorecard to implement strategic ideas and monitor the company’s performance.

Check It Out

Change Management

Power and Influence

A Harvard Business simulation, where the learners lead organizational transformation at a sunglasses manufacturing company as a change leader—build credibility, manage resistance, and use influence strategically to drive meaningful, lasting change.

Check It Out

Finance and Accounting

Data Detective

Analyze real-world financial data to uncover which companies lie behind disguised balance sheets and income statements. Strengthen your financial acumen and storytelling skills by connecting business models to performance metrics.

Check It Out