Forio teamed up with Dr. Sam Savage of Stanford University to design and develop an online version of his Excel-based investment portfolio simulator game.

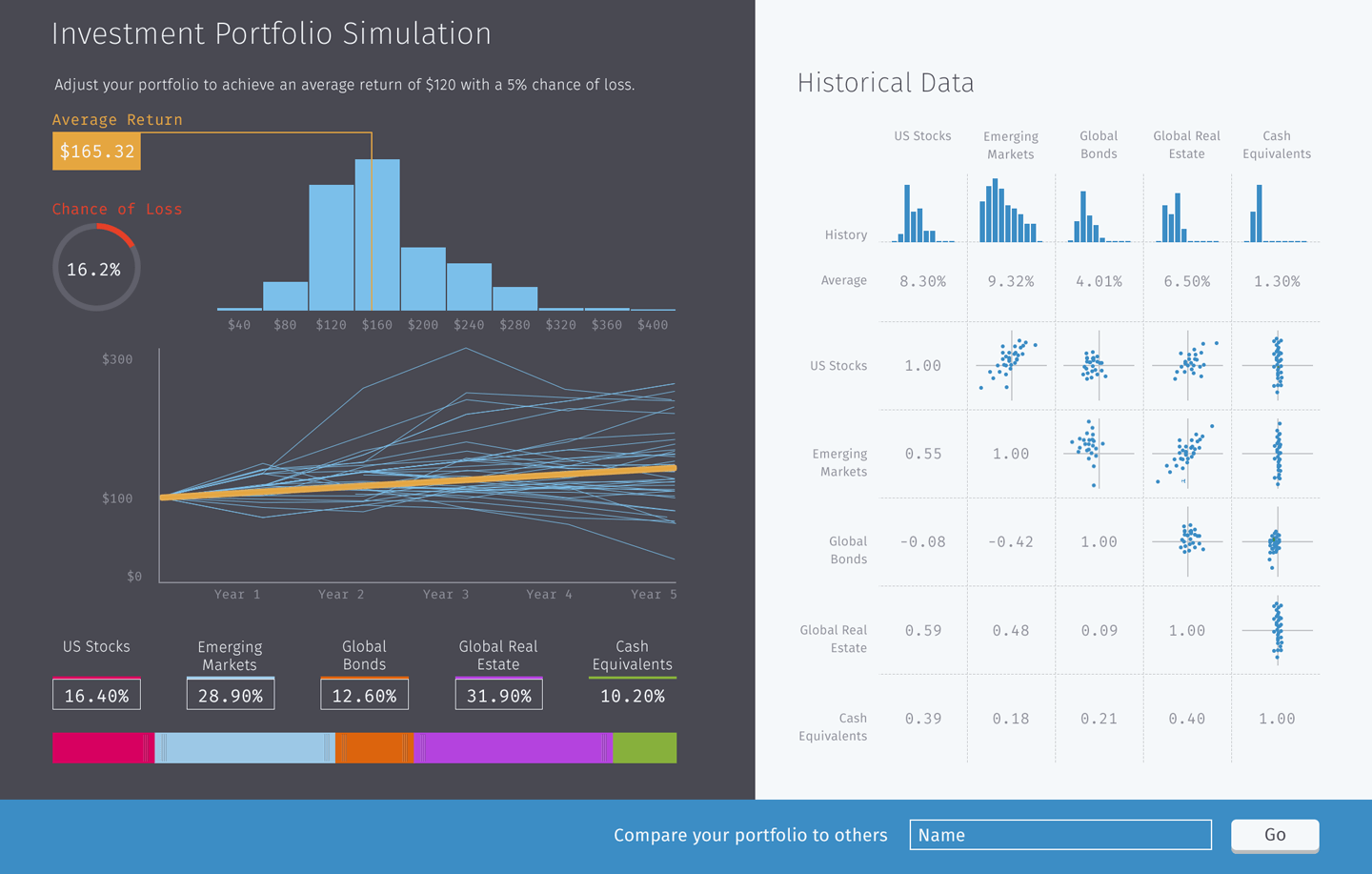

The Investment Portfolio Simulation game is based on examples from his book The Flaw of Averages. The model uses a Monte Carlo method to simulate stock market positions based on historical data. Players adjust a portfolio across US stocks, emerging markets, global bonds, global real estate, and cash equivalents, seeking to achieve an average return of at least $120 while minimizing the chance of losing $5. Anyone can play the investment portfolio simulation, and then see where their results rank on a public leaderboard. The goal is to illustrate the concept of “flawed” averages, that is, the idea that “plans based on average assumptions are wrong on average.”

Experience this simulation.

Experience this simulation.