Bond Trader Simulation Overview

Bond Trader provides a powerful context for teaching foundational themes such as equilibrium-required return, pricing of information, and financial substitutes among others.

Bond Trader Simulation Overview

Bond Trader provides a powerful context for teaching foundational themes such as equilibrium-required return, pricing of information, and financial substitutes among others.

Time Requirement

The Story

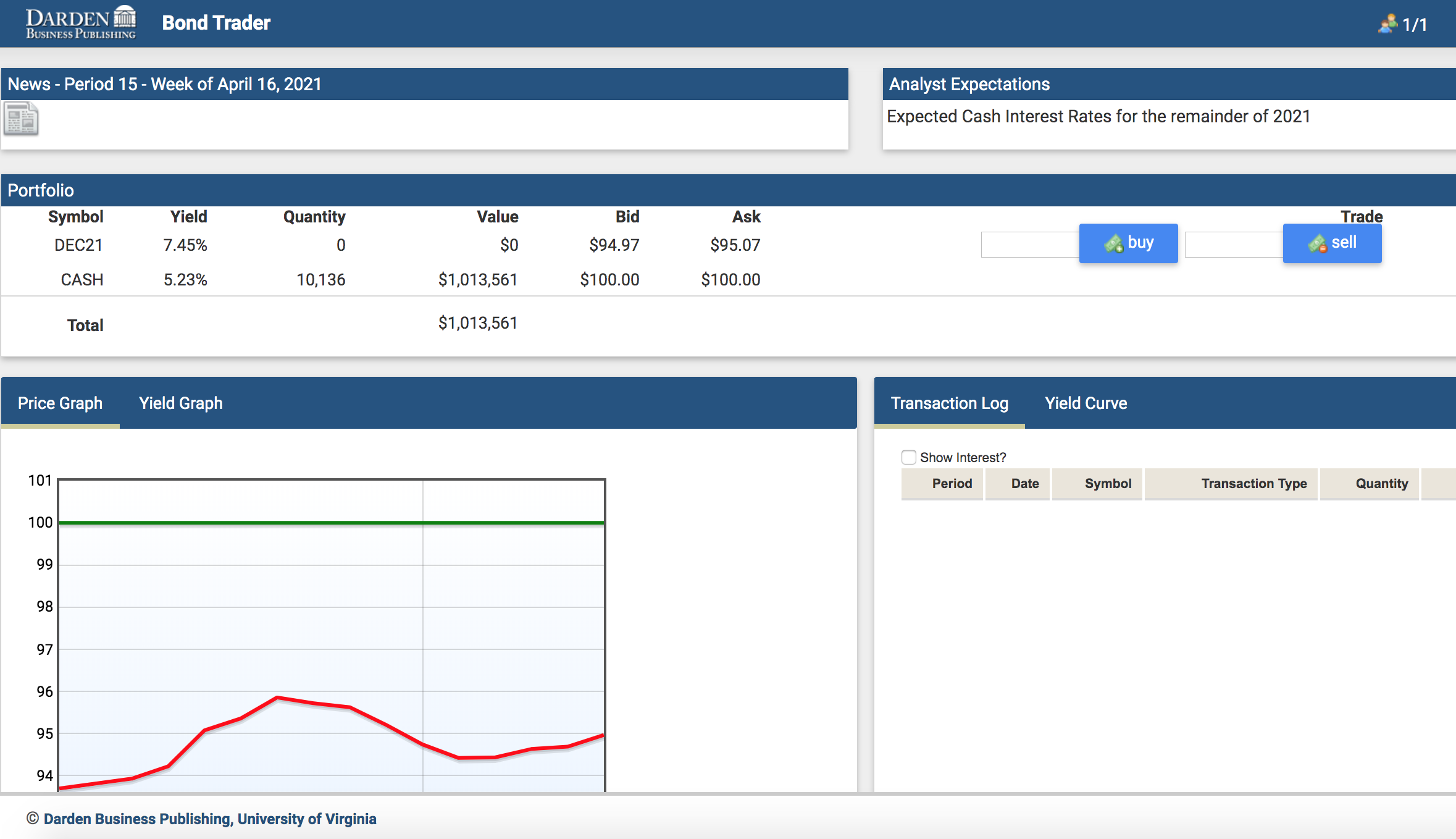

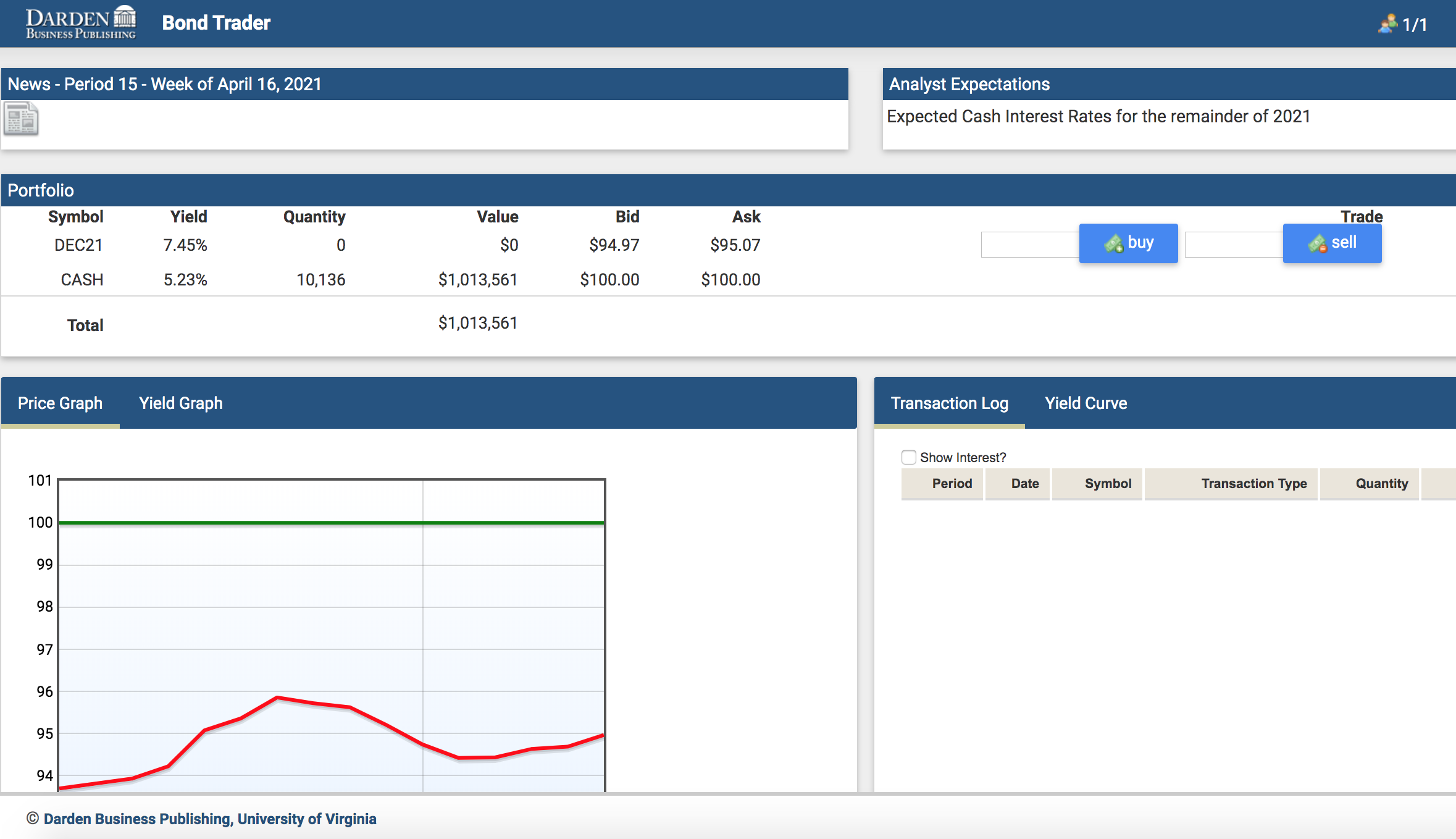

In this Finance bond trading simulation, learners compete in teams or individually to maximize the value of a bond trading portfolio by choosing when to take positions in bond securities and when to hold cash. To increase engagement, the participants performance is ranked against their peers. Learners make buy-and-sell decisions for each weekly trading periods of 10-15 seconds.

The Bond Trader simulation lets participants experience the impact of the collective market decisions as bond prices dynamically evolve based on the aggregate buy-and-sell order flow from learner and computer traders in the market, using an internet-based interface.

Learning Focus

Topics Covered

The Bond Trader simulation is WCAG Compliant for the participants.

Each simulation comes with a Teaching Guidebook for the facilitator along with 1:1 facilitator training and free trials.

Other Simulations You May Like

Connect with a Specialist!

+1 (415) 440.7500